Important Notes:

John Addeo, Global Chief Investment Officer, Fixed Income Strategies (Public Markets)

20 December 2023

2023 saw the most aggressive tightening cycle in advanced economies for decades. However, our view is that the US Federal Reserve Board (Fed) has most likely reached peak rates, and therefore we expect the Fed to start cutting rates in the second half of 2024. That said, an income-oriented solution such as the Manulife Global Multi-Asset Diversified Income Fund (the Fund) is targeted to deliver a relatively stable income outcome, via the flexible adjustment of diversified traditional (fixed income) and non-traditional (option writing) income sources.

We have a high conviction that income-oriented strategies can serve well in an environment that has to contend with the uncertainties driven by the broader structural themes of deglobalization, decarbonization and changing demographics. We believe income-oriented strategies offer portfolio resilience and a defensive bias to a client’s overall allocation, and therefore we foresee that income investing will remain attractive into 2024.

Let’s get started with a recap of what we’ve seen so far this year:

The Fund returned 8.53% year-to-date 20231. Portfolio de-risking marked much of the year given concerns around a recessionary outcome and elevated default rates that could impact the riskier segments of the High Yield allocations. The team cut exposure to the more speculative grade credits, including CCC-rated bonds and emerging-market (EM) issuance. In turn, the team increased the portfolio’s positions in developed market investment grade (IG) bonds, navigated markets through asset allocation decision making across equity sectors and opportunistically implemented call-writing on high yield (HY) indices, in addition to the more persistent income generation from the call and put writing on equity indices.

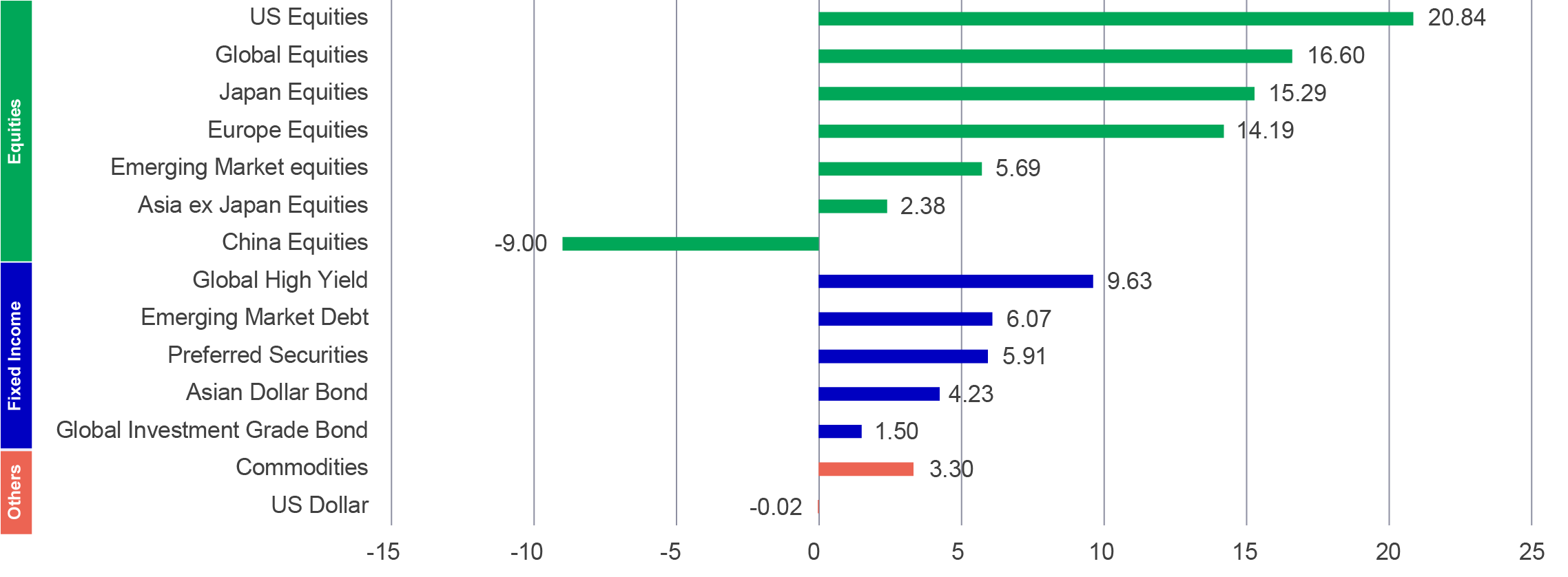

Chart 1: 2023 year-to-date major asset classes performance (%)2

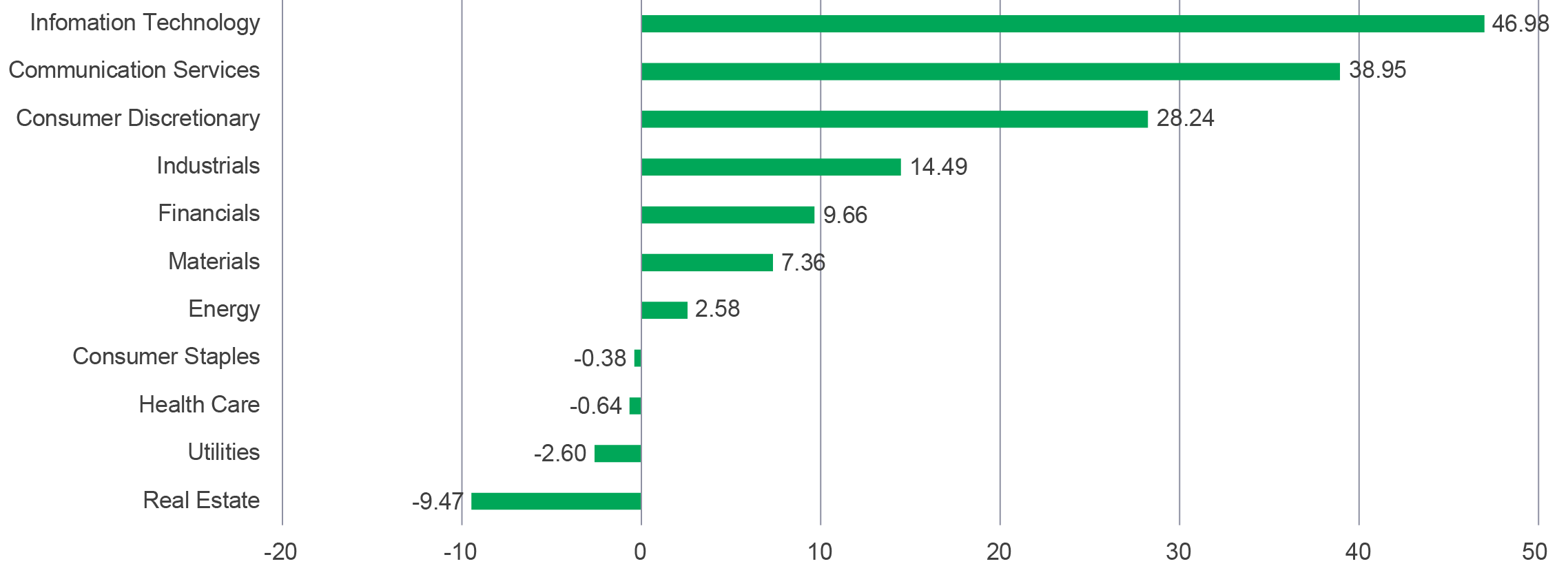

Chart 2: 2023 year-to-date global equity sectors performance (%)2

More importantly given the primary objective of the portfolio is to deliver an attractive income outcome, the Fund has delivered an average distribution yield of 7.9% since inception for the AA (USD) MDIST (G) share class3.

On a year-to-date basis2, drivers of performance have largely been from equities, particularly the more growth oriented names in consumer discretionary and tech Sectors which have led the market rally, as further rate rises, and potential subsequent rate cuts, became re-priced into markets next year.

Detractors to the portfolio on a year-to-date basis have been some regional US bank issues, a Healthcare equity name and a US chemical manufacturing company.

Recent data releases around a moderation of inflation expectations, soft ISMs (Institute for Supply Management indices) as well as a softer US labour market support our view that the Fed is likely at (or very near) peak rates. We see the Fed having largely contained the inflation cycle and are now pivoting to contain the business cycle. Looking ahead into 2024, we maintain our base case that the US economy should weaken in the coming months. The expected deteriorating economic conditions could push the Fed into cutting rates in the second half of 2024 in order to manage the business cycle. In saying that, US rates remain elevated compared to previous years and can sit at elevated levels should the US economy remain robust or fare better. Given our belief that the downturn has been postponed rather than cancelled, we continue to forecast that recessionary conditions will envelop much of the globe. We also expected continued near-term market volatility.

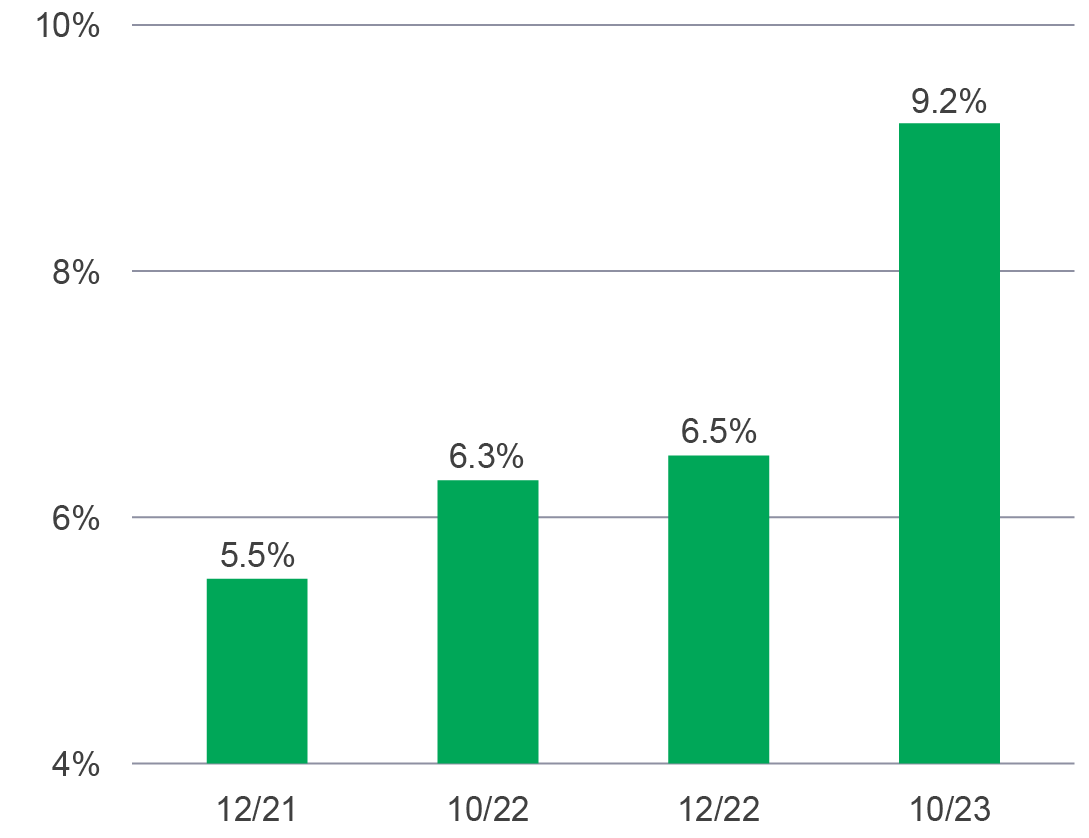

The Fund was incepted in 2019, during a low-rate environment and had an initial payout of approximately 7.5%4. When the Fed started its rate hike cycle around 2022, the Fund’s distribution yield was able to capture those higher rates and therefore the payout increased gradually to 8.5-9% into 20235 , alongside a cumulative Fed rate increase of +525 basis points.

If US rates decline in 2024, we believe the Fund can still produce yields like those seen historically, with 80% of the Fund’s income coming from fixed income securities and option writing. The Fund has over 700 names and taps into a diverse breadth of traditional and non-traditional income sources. Within the fixed income segment of the Fund, the team are able, where appropriate, to shift their focus across the quality spectrum, across different market environments, from higher quality investment grade securities (including investment grade bonds and select sectors within preferred securities) for defensive positioning, to high yield opportunities across developed and emerging markets during periods when there is an increased appetite for risk. Income remains the primary objective and therefore the team are looking for fixed income securities issued from corporates that have transparent cashflows in order to sustain their coupon payments.

While adding high yields can provide a higher income to the Fund, credit quality and risk management are equally important. Over the past 12 months, markets have expected a recession, during which the lower-rated issuances had a higher chance of default. If the recessionary picture recedes, we could assume increasing high yield and EM debt exposures – the latter where we see good spread opportunities and where valuations look attractive.

In the US high yield market, refinancing risks are uppermost in investors' minds. Nearly USD100 billion of debt matures over the next two years, representing almost 10% of the high yield universe (see chart 3).

Mindful of this, the team have aimed at mitigating refinancing risks by gradually shifting away from speculative grade credits towards the BB rated and investment grade buckets. The fixed income component of the Fund holds less than 2% of its assets in US high yield credit maturing over the next two years6. While interest rates remain elevated, the team prefer strong balance sheets with no near-term maturities when lending to highly leveraged issuers.

If the outlook for the dollar becomes more pessimistic following the expectations of a rate cut, the Fund could look at establishing positions in local-currency debt (which were not overly explored in 2023) and add emerging markets foreign exchange exposure.

Chart 3: Percentage of US high yield benchmark maturing within 2 years7

Option writing implementation has been persistent throughout the year and has been a solid contributor to income generation through option premium capture, by adjusting the percentage of equities with a call-writing structure, altering strike rates, and increasing the frequency of implementation, to take advantage of variations in implied volatility.

Option writing is persistent each month on global and regional equity indices and ETFs. Call over-writing has historically been implemented on equities. However, where appropriate, the team have also implemented call writing on high yield indices where there is a tactical view on spreads.

An important point to note about the key features of the Fund is not only the diversified nature of the portfolio, but also the in-built flexibility of the portfolio to shift across fixed income and equities, across geographies, foreign exchange, emerging markets (EM) versus developed markets (DM), take opportunities in Europe, Asia and or Japan, when permitted, as well as vary option writing implementation. In regards the latter point, where there is high conviction of equity market upside the Fund could remove call writing in order for the equities in the portfolio to participate in market upside. Likewise if there is a view of elevated valuations and limited near term upside, the team have the flexibility to write more calls in order to sell away potential upside for income today.

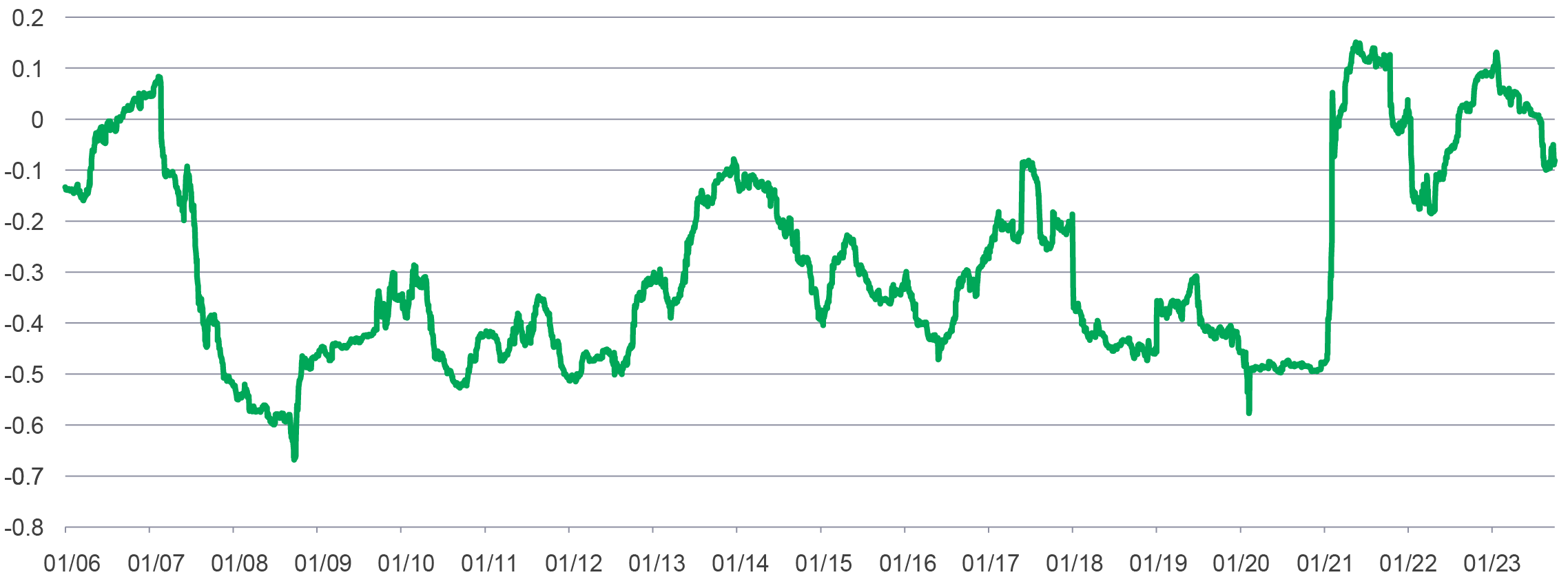

Mathematically, higher interest rates lead to higher call premiums; the higher forward more than offsets the increased discount factor. However, this effect is small for the shorter tenors the Fund deploys and would nonetheless be drowned out by the market impact of the interest-rate regime.

Some economic regimes, such as falling rates, are associated with declining implied volumes and lower premiums, especially if the rate drops due to softer inflation, etc. In other scenarios, a fall in rates is due to a market selloff, which increases premiums.

Chart 4: Correlation between the daily change in one-month “At the Money” implied S&P volatility and the daily change in the US 5-year government yield8

In the current environment, the team have added equity exposure to capture growth and have held overweights in IT and Consumer Discretionary albeit less overweight currently than the Fund was a few months ago. If the rate landscape pivots, the team could look to rotate into higher allocations in the relatively higher-beta sectors to reflect a change in bottom-up fundamentals and/or the macro and market backdrop. Also, the team could add some growth-oriented names as rates decline. The team however do not foresee significantly higher overall equity allocations, as this would sacrifice allocations to fixed income and, therefore, sacrifice yield.

Recent positioning across the equity component of the Fund has been to add more to Healthcare names given some attractive fundamentals and stock specifics, as well as reducing the underweight to Industrials. The team have an overweight towards IT, Financials, Healthcare, Consumer Discretionary and Energy whilst underweight in Industrials, Communication Services, Consumer Staples and Utilities equities.

In terms of geographical allocation, the Fund’s equities have long focused on developed markets (with a US bias), with little emerging market or Asia exposure, even though the portfolio has the capability to do so.

Should we anticipate performance of non-USD assets starting to improve, a switch into Asia, China, broad EM or Europe is possible if better growth, valuation opportunities or catalysts emerge.

In the prevailing uncertain environment, expectations for 2024 will remain just as important to ensure a flexible allocation in order to navigate the extent to which deglobalization continues to influence fragmented behaviours and the impact it has on supply chains and inflationary pressures. No matter how the market or rates evolve, the principal objective of the Fund – maintaining a high and relatively stable income profile – is expected to remain consistent. While we anticipate name/sector shifts across asset classes to be driven by bottom-up fundamentals, the Fund’s overall asset allocation is expected to be dominated by Fixed Income exposures to drive yield generation, whilst obtaining exposure to equities for earnings growth and where appropriate generating yield through option premium capture.

Income investing has become a relatively more attractive theme for the investor community as rates are expected to sit at higher levels over the coming year. We believe a multi-asset income focused approach offers broad diversification, risk mitigation whilst consistently seeking to deliver a high sustainable income profile.

1 Manulife Investment Management, as of 30 November 2023. Cumulative performance: Since launch to date: +9.69%; Calendar year performance: 2019 (since launch 25 April 2019 to year end): +6.27%; 2020: -0.47%; 2021: +9.85%; 2022: -13.02%. Past performance is not indicative of future performance.

2 Source: Bloomberg, FactSet, data as of 30 November, 2023. Performance is in USD and total return. Equities indices represented by MSCI indices. Preferred securities = ICE BofAML U.S. All Cap Securities index; EM Debt = JPM EMBI. Asian Dollar Bond represented by Markit iboxx index. Global high yield bond = Bloomberg Global High Yield total return index unhedge. Global Investment grade bond represented by FTSE indices. Commodities = TR CRB Index. US dollar = US dollar index. Past performance is not indicative of future performance.

3 Source: Manulife Investment Management. Distribution yield applies only to AA (USD) MDIST (G) class, as of 30 November 2023. Dividend rate and dividend are not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Please note that a positive distribution yield does not imply a positive return. Annualised yield = [(1+distribution per unit/ex dividend NAV)^distribution frequency]–1, the annualised dividend yield is calculated based on the latest relevant dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Average distribution yield is the simple monthly average of distribution yield recorded since Fund launch to 30 November 2023. Fund inception date: 25 April 2019.

4 Annualised yield = [(1+distribution per unit/ex dividend NAV)^distribution frequency]–1, the annualised dividend yield is calculated based on the latest relevant dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Dividend is not guaranteed.

5 Source: Manulife Investment Management, as of 30 November 2023. Distribution yield applies only to AA (USD) MDIST (G) Share class. Dividend rate is not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Please note that a positive distribution yield does not imply a positive return. Past performance is not indicative of future performance. Annualised yield = [(1+distribution per unit/ex dividend NAV)^distribution frequency]–1, the annualised dividend yield is calculated based on the latest relevant dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Diversification or asset allocation does not guarantee a profit nor protect against loss in any market.

6 As of 30 November 2023. Information about the portfolio holdings is historical and is not indication of the future composition. Diversification or asset allocation does not guarantee a profit nor protect against loss in any market.

7 Source: BofA Securities, 1 November 2023. US high yield benchmark refers to ICE BofA US High Yield Index.

8 Source: Bloomberg & Manulife Investment Management, data as of 16 November 2023.

Five Macroeconomic Themes for 2025: a Global Economy in Transition

2025 is shaping up to be a year of transition. With that in mind, we explore five key forces that we believe will drive the global economy and markets this year. Return to this page periodically for additional timely insight and resources to help guide you through 2025.

2025 Outlook series: greater china equities

In this 2025 outlook, the Greater China Equities team will elaborate on four reasons for more upside potential going into 2025 despite potential US tariff concerns and geopolitical headwinds, as well as investment opportunities based on the 4As positioning for Greater China equity markets.

Fed easing cycle supports US fixed income assets

We believe that the dynamic investment approaches of the Preferred Securities and the USD Income (USD core fixed income) help navigate economic and rate cycles, offering attractive investment opportunities for fixed-income investors seeking higher-quality assets with relatively stable income.