June 14, 2021

Last year, we released our first edition of the “Investing When Markets Are Volatile” series, where we discussed three lessons from history that all investors should know about market volatility. We’ve shown that in times of extreme market volatility, staying calm and thinking long-term are sensible decisions that investors can make to use time to their advantage.

Today, it seems that we are on the cusp of the end of this pandemic — vaccines are being rolled out, many economies are reopening, and forecasts imply a strong rebound of the global economy. However, there are still pockets of challenges, such as intermittent surges in infection cases, uneven progress in vaccination efforts, and potential spike in inflation as global economic activity recovers.

With this backdrop, investors may ask: (1) What happened to the local and global equity markets in 2020? (2) Did the three lessons actually work well in practice? (3) Would it still be wise for investors to apply these same lessons in their investment decisions right now?

In this new issue of Investment Insights, we will share with you the answers to these important questions.

Last year, we looked at three major asset classes through their benchmarks—Philippine Equities, US Equities and Hong Kong / China Equities—and how they fared during the last four crises, with the last one being the COVID-19 pandemic. We have now updated our analysis to include the one-year bounce of the COVID-19-induced bottom (refer to the blue bar in the image below).

Source: Bloomberg. Past performance is not an indication of future results.

Notes:

1Return from previous peak before event to bottom after event. Event may be 100% responsible for the drop in prices

2Return from the bottom to 1 year after.

Based on the data of each market, we can see that after steep sell-offs, markets generally had rebounds that were significant and sustained. This market behavior was repeated in 2020 when the COVID-19 pandemic began to take centerstage. All three markets had significant bounces one year after hitting the bottom in March 2020, with returns of 39%, 75% and 56% for the Philippines, US, and Hong Kong/China equity markets, respectively. Investors who stayed invested and even added to their investments in these markets made the correct and profitable decisions.

While the end of the pandemic and its ripple effects on markets remain uncertain, history taught us that despite our emotional instincts, it makes sense to invest and stay invested, particularly for those with a longer investment horizon.

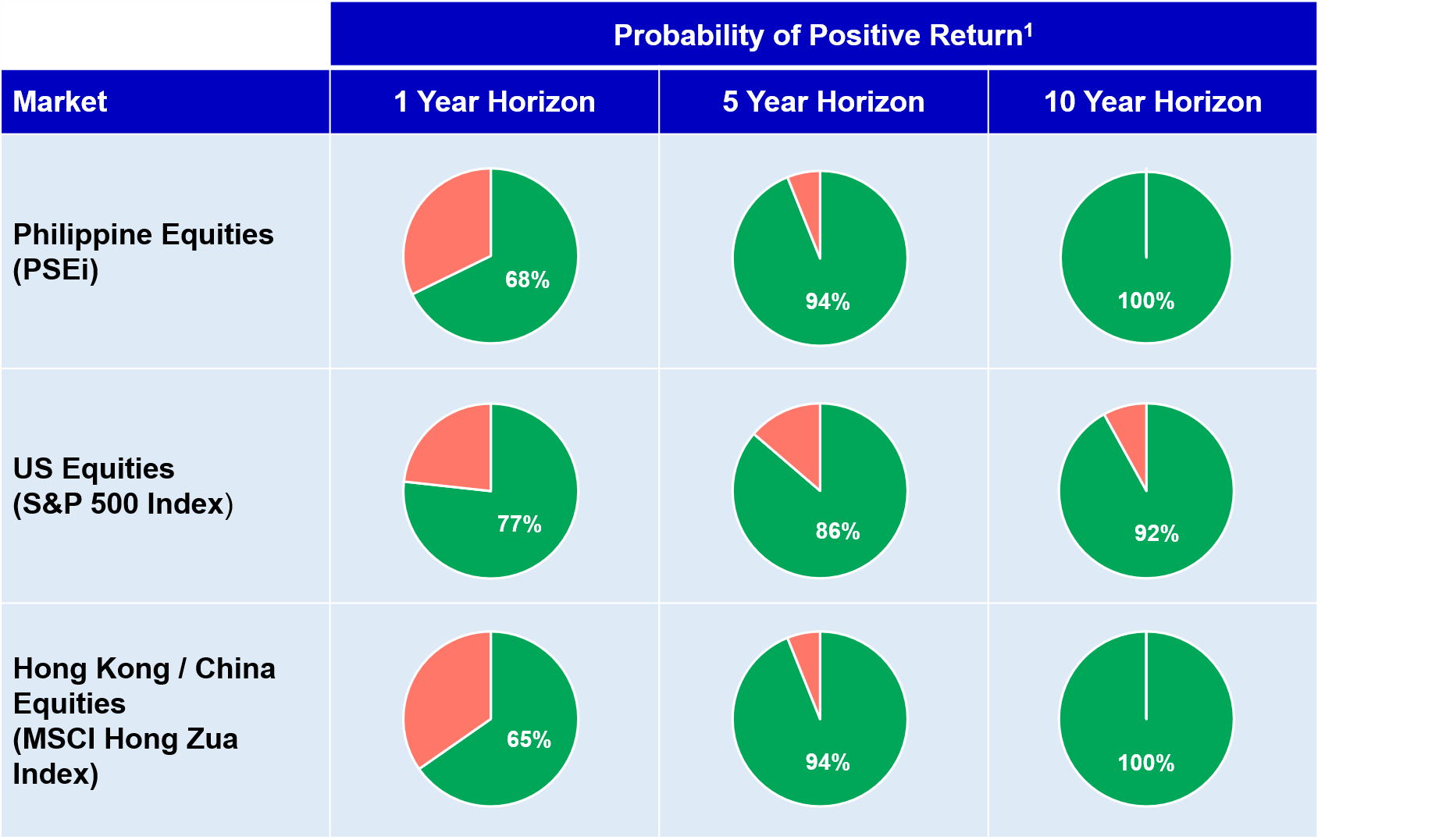

Last year, we looked at the same benchmarks’ long histories across three investment horizons—one year, five years, and 10 years. We have now extended the data range till March 31, 2021, expanding the coverage of the analysis up to more than 21 years and more importantly, including the impact of COVID-19.

Source: Bloomberg. Based on rolling monthly return data from December 31, 1999-March 31, 2021.Past performance is not an indication of future results. Notes:

1Count of periods that had positive returns over total count of periods. For example, for the PSEi, from December 31, 1999-March 31, 2021 there were 245 total 1-year periods, 166 of which had positive returns; 197 total 5-year periods, 185 of which had positive returns; and 136 total 10-year periods, all of which had positive returns.

While several black swan events, including the COVID-19 pandemic, caused sharp market disruptions over the last 21 years, the data from the three different markets suggest that the investment horizon has an impact on the probability of generating positive returns.

The global market turmoil triggered by the pandemic has underscored the view that as investment horizon increases, the chances of earning positive returns also increase as more time helps smooth out the volatility of returns.

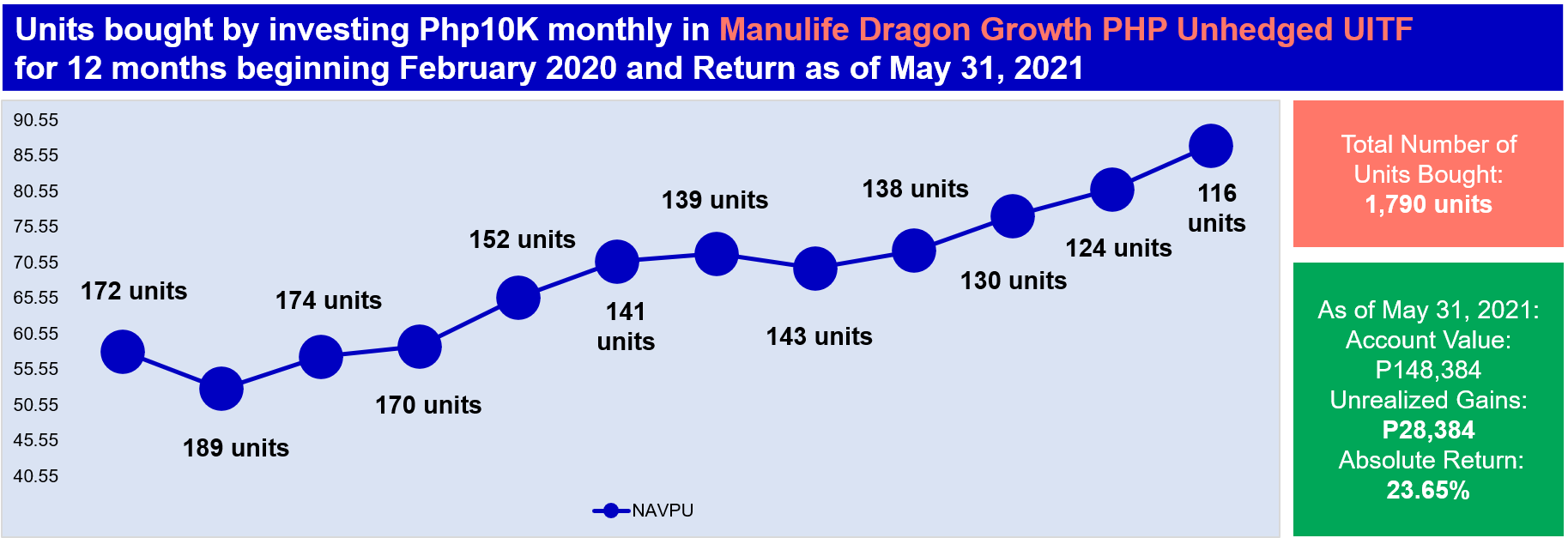

Last year, we mentioned how hard it is to time the market. The year 2020 was no exception—the bottom for most markets happened around March 2020 and many investors most likely missed investing exactly at the bottom. This is where cost averaging, a strategy involving periodic and regular investing, comes into play.

This year, we have updated the data to see how much investors could have earned if they invested monthly for 12 months, even if they did not catch the bottom.

Source: Bloomberg. Past performance is not an indication of future results. Assumption: Client invested P10,000 once a month for 12 months starting February 2020 in three Manulife Investment Management unit investment trust funds (UITFs) – Manulife Equity Wealth (Philippine Equities), Manulife American Growth Feeder Fund PHP Unhedged (US Equities) and Manulife Dragon Growth Feeder Fund PHP Unhedged (Hong Kong / China Equities).

The year 2020 confirmed our third and final lesson—catching the bottom is not crucial in generating good returns if investors adopt regular investing or cost averaging. It is a proven investment strategy that can mitigate investors’ behavioral biases, such as being too cautious when prices are low and being too greedy when prices are high, and also enable them to ride out market volatility in a more proactive way.

These history lessons affirm that with the right strategies—long term investing and cost averaging/regular investing—investors can take advantage of opportunities to grow their wealth despite market volatility.

Investors can use these strategies hand in hand with the diverse range of distinctive Manulife Investment Management UITFs, which provide access to local and global investment strategies that suit different goals, needs and risk profiles.

Disclaimer:

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. The information and/or analysis contained in this material have been compiled or arrived at from sources believed to be reliable but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. Neither Manulife Investment Management nor its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein.

This material was prepared solely for informational purposes and does not constitute a recommendation, professional advice, an offer, solicitation or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to one’s individual circumstances, or otherwise constitutes a personal recommendation to a prospective investor. Past performance is not an indication of future results. Investment involves risk.

The products and services of Manulife Investment Management and Trust Corporation are trust and/or investment solutions and NOT deposit products, obligations of, guaranteed, or insured by the company, its parent company or its affiliates. These products are not insured nor governed by the Philippine Deposit Insurance Corporation (PDIC). Due to the nature of investments, yields and potential yields cannot be and are not guaranteed. Any loss/income arising from market fluctuations and price volatility of securities held by funds, even if invested in government securities, is for the account of the client/investor. As such, units of participation of an investor, when redeemed, may be worth more or be worth less than his/her initial investment contributions. When presented, historical performance is purely for reference purposes and is not a guarantee of similar future results. Manulife Investment Management and Trust Corporation is not liable for losses unless upon willful default, bad faith, or gross negligence on its part.

How to Protect Yourself and Your Accounts Online

Technology has enabled us to live with convenience and accessibility more and more each day. We have great power at our fingertips and can effortlessly perform numerous tasks from our phones and laptops, including managing our finances online. However, as we grow more adept at using these apps and tools, and as technology evolves and becomes increasingly sophisticated, we must continually educate ourselves on how to safeguard our data and security,and avoid becoming targets of cybercriminals.

Manage your expenses but don’t forget retirement planning

By the time you hit 30, the cost of hosting a wedding, having kids, and buying property should not be taken lightly. It’s worth adhering to the three principles of wealth management.

Tips to manage your budget

Keeping an eye on income and spending is not easy. However, working to a budget can simplify matters. Once you have established a reliable system that tracks your money, you’ll find it easier to take control of your finances.